The Prime Minister’s Youth Business Loan Scheme is a flagship initiative by the Government of Pakistan to foster entrepreneurship, reduce unemployment, and promote economic growth. This program provides financial assistance to young entrepreneurs, enabling them to start or expand their businesses. In this article, we’ll explore the scheme’s key features, eligibility criteria, benefits, and frequently asked questions (FAQs).

What is the Prime Minister’s Youth Business Loan Scheme?

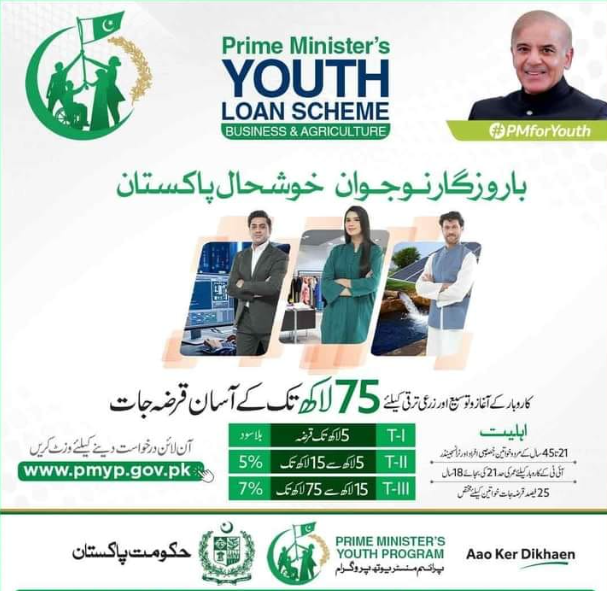

Launched in 2013, the Prime Minister’s Youth Business Loan Scheme is designed to empower young individuals aged 21 to 45 years by providing them with access to affordable financing. The program offers loans ranging from PKR 100,000 to PKR 5,000,000 at a low markup rate, making it easier for aspiring entrepreneurs to turn their business ideas into reality.

The scheme is managed by the Government of Pakistan in collaboration with participating banks and financial institutions. It focuses on promoting small and medium-sized enterprises (SMEs), which are considered the backbone of the economy.

Key Features of the Scheme

- Loan Amount:

- Minimum: PKR 100,000

- Maximum: PKR 5,000,000

- Markup Rate:

- The markup rate is as low as 6% per annum, making it one of the most affordable loan options in the country.

- Loan Tenure:

- The repayment period is up to 8 years, including a grace period of 1 year.

- Collateral-Free Loans:

- Loans up to PKR 500,000 are provided without the need for collateral.

- Gender Inclusion:

- Special emphasis is placed on empowering women entrepreneurs, with 50% of the loans reserved for female applicants.

- Training and Mentorship:

- Successful applicants receive business training and mentorship to help them manage their ventures effectively.

Eligibility Criteria

To qualify for the Prime Minister’s Youth Business Loan Scheme, applicants must meet the following criteria:

- Age: 21 to 45 years

- Nationality: Pakistani citizen

- Business Plan: A viable business plan or proposal

- Credit History: No prior loan defaults

- Educational Qualification: Minimum matriculation (10th grade)

- Business Experience: Preference is given to individuals with relevant business experience

How to Apply for the Scheme

- Online Application:

Visit the official website of the Prime Minister’s Youth Program and fill out the online application form. - Document Submission:

Submit the required documents, including your CNIC, business plan, and educational certificates. - Evaluation Process:

Your application will be evaluated by the relevant authorities, and you may be called for an interview. - Loan Disbursement:

Once approved, the loan amount will be disbursed through a participating bank.

Benefits of the Prime Minister’s Youth Business Loan Scheme

- Financial Inclusion: Provides access to credit for individuals who may not qualify for traditional bank loans.

- Job Creation: Encourages entrepreneurship, leading to job creation and economic growth.

- Skill Development: Offers training and mentorship to enhance business management skills.

- Women Empowerment: Promotes gender equality by reserving 50% of loans for women.

- Low-Cost Financing: Affordable markup rates reduce the financial burden on borrowers.

Frequently Asked Questions (FAQs)

1. Who is eligible for the Prime Minister’s Youth Business Loan Scheme?

- Pakistani citizens aged 21 to 45 years with a viable business plan and no prior loan defaults are eligible.

2. What is the maximum loan amount under this scheme?

- The maximum loan amount is PKR 5,000,000.

3. Is collateral required for the loan?

- No collateral is required for loans up to PKR 500,000. For larger amounts, collateral may be required.

4. What is the markup rate for the loan?

- The markup rate is 6% per annum.

5. How long is the repayment period?

- The repayment period is up to 8 years, including a 1-year grace period.

6. Can women apply for this loan?

- Yes, 50% of the loans are reserved for women entrepreneurs.

7. What documents are required for the application?

- CNIC, business plan, educational certificates, and other relevant documents.

8. How can I apply for the loan?

- You can apply online through the official website of the Prime Minister’s Youth Program.

9. Is there any training provided under this scheme?

- Yes, successful applicants receive business training and mentorship.

10. What types of businesses are eligible for the loan?

- All legal and viable business ideas are eligible, including small and medium-sized enterprises (SMEs).

PM Youth Business Loan Application

Conclusion

The Prime Minister’s Youth Business Loan Scheme is a transformative initiative that empowers young entrepreneurs to contribute to Pakistan’s economic development. By providing affordable financing, training, and mentorship, the program not only supports individual business ventures but also creates job opportunities and drives economic growth.